The Real Return on Rolex, Investing in Luxury Watches

Investing in luxury watches has been a topic many people have covered. With the FIRE (Financial Independence, Retire Early) movement, many people are looking for other ways to invest their money to give them passive income. Their goal for financial freedom is something that has brought people to many different asset classes, wrist watches being one of them.

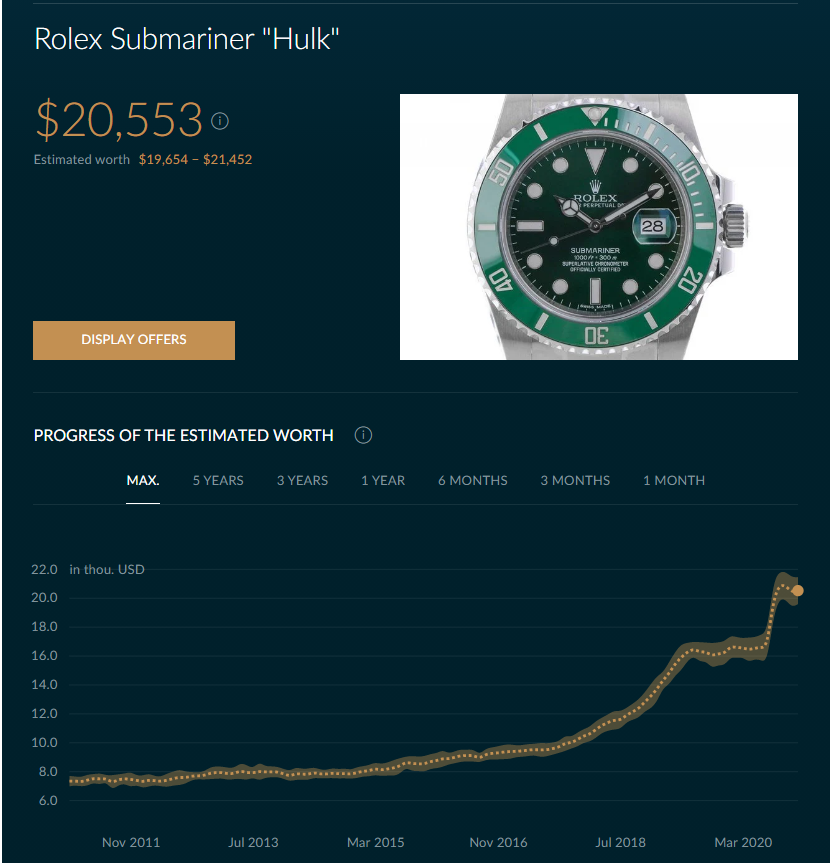

Rolex is without a doubt probably the most investment friendly luxury watch brand. Their watches hold value for a tremendous amount of time because of how in demand they are, but their are obviously models that have appreciated in value substantially. Take for example, the Rolex Submariner Hulk reference 116610. This watch originally cost around $7,300 in 2009, now is sells for around $20,000! This watch appreciated 173% in value in just 11 years.

Another great example of a watch that has increased in value and given people passive income just for owning the watch is the Rolex Explorer II reference 16570. This watch originally was selling from $3,600 in 2009 and in 2020, is selling for $8,400. More than double the price, the watch in 11 years appreciated 133%.

In our video we cover four other Rolex watches that have seen similar appreciation in value that was a great way for investors to generated passive income over the last 10 years. The real question though is whether or not this trend will continue. As the old saying goes, past performance is not indication for future success. With prices already extremely high do Rolex watches still have room to appreciated in value?

Enjoy!

Disclaimer: This is not investment advice and should not be used for investment purposes. You are responsible for doing your own research before investing in any asset.